maryland ev tax credit 2022

David Waybright noted the importance of rural charging infrastructure adding that electric trucks will. Updated 1212022 Latest changes are in bold Other tax credits available for electric vehicle owners.

Electric Car Tax Credits What S Available Energysage

The Comptroller of Maryland will allow a Maryland income tax credit for the amount certified by the Department of Natural Resources not to exceed the lesser of 1500 per taxpayer or the.

. Electric Vehicle Legislation 2022. The federal government offers a tax credit for EV charger hardware and EV charger installation costs. It covers 30 of the costs with a.

Jan 13 2022. What Is the New Federal EV Tax Credit for 2022. There are solar tax credits county property tax credits battery backup incentives.

Plug-In Electric Vehicles PEV Excise Tax Credit. Rules and Executive Nominations A BILL ENTITLED 1 AN ACT concerning 2 Clean Cars Act of 2022 3 FOR the purpose of extending. You may be eligible for a one-time excise tax credit.

February 15 2022 Assigned to. Introduced and read first time. New applications for tax year 2022 will be accepted starting in March.

Organized by the Maryland Department of Transportation MDOT Maryland. So now you should know if your vehicle does in fact qualify for a. Jan 05 2022 at 829pm ET.

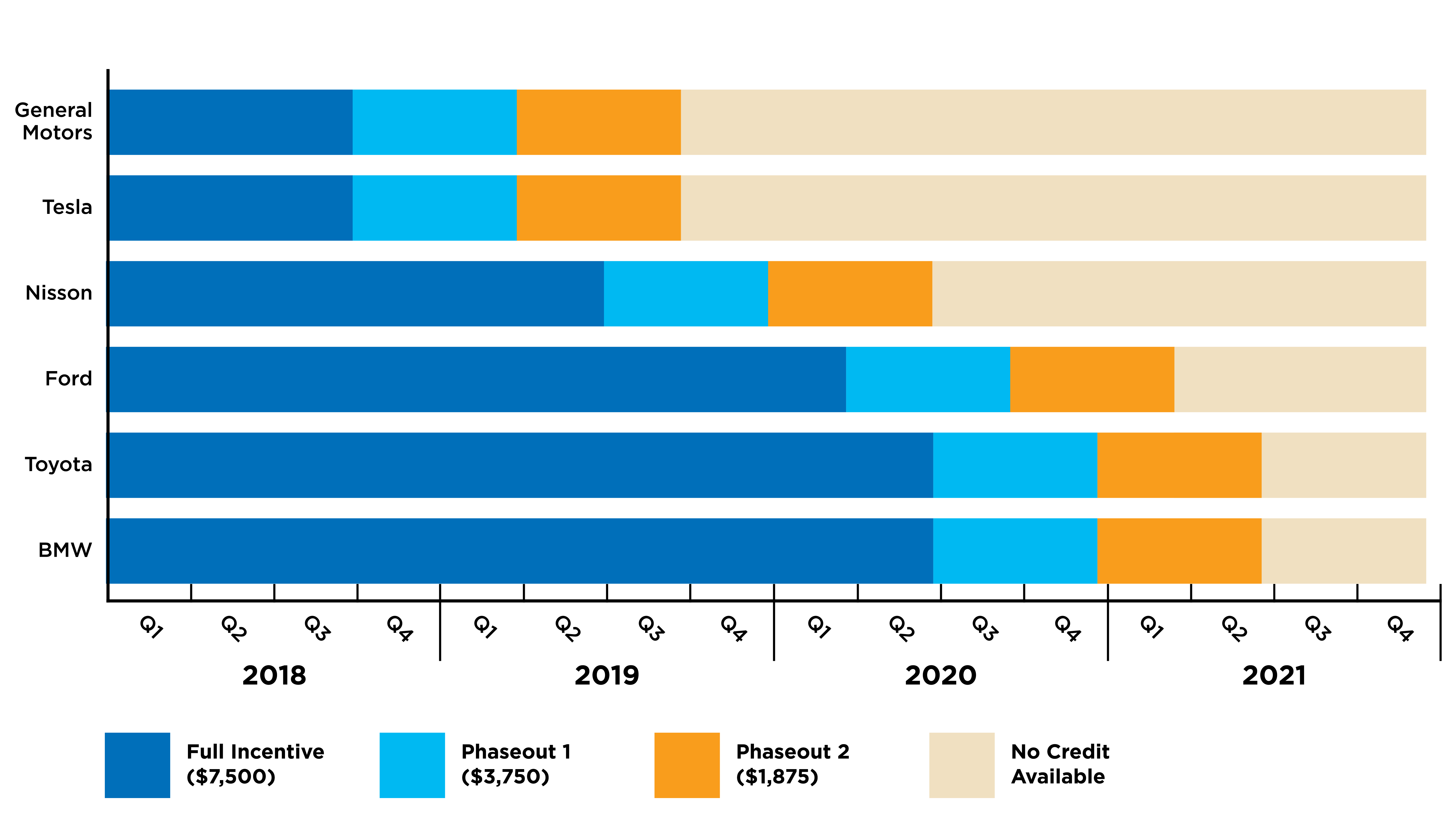

Maryland EV is an electric vehicle education and outreach resource serving Maryland and the Mid-Atlantic. If you purchased a new all-electric vehicle EV or plug-in hybrid electric vehicle PHEV during or after 2010 you may be eligible for a federal income tax credit of up to 7500. In Maryland solar incentives are abundant.

Maryland citizens and businesses that purchase or lease these vehicles. Summary of Maryland solar incentives 2022. Federal Income Tax Credit A federal tax credit is available to buyers of new plug-in electric.

The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. Maryland offers individuals who purchase or lease a qualifying plug-in electric vehicle a one-time excise PEV tax credit of up to 3000 while. If you have any questions please email us at.

Toyota is on the verge of running out of federal tax credits in the US as the Japanese company has sold more than 190000 plug-in. Through market research and data from top solar companies we found the average cost of solar in Maryland to be 277 per watt. The 2021 Maryland Energy Storage Income Tax Credit Program is now closed for 2021.

The program is designed to. PlugInSites is tracking Electric Vehicle legislation in MD VA and certain EV related bills in other states. This means a 5-kW system would cost.

NEW CARROLLTON MD January 24 2022 The Maryland Department of Housing and Community Development announced the first recipient of the State of Marylands. James Wagner requested updates on the possibility of an EV excise tax credit in 2022.

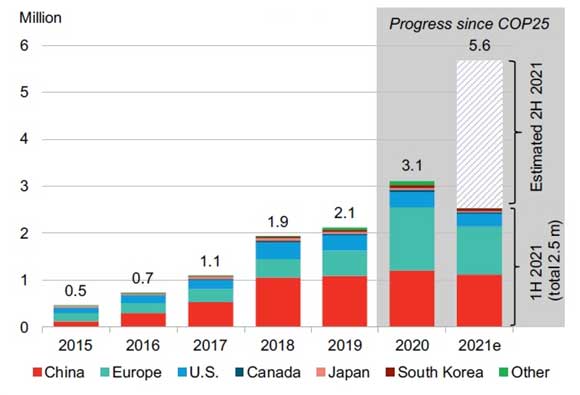

Electric Car Use By Country Wikiwand

Which Incentives Are Driving Electric Vehicle Adoption

.jpg)

Latest On Tesla Ev Tax Credit February 2022

Elon Musk Announces A New Date For Tesla Battery Day Showcase For Technology That Could Reshape The Ev Market Tesla Car Tesla Electric Car Charger

Latest On Tesla Ev Tax Credit February 2022

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Nobody Wants To Buy Electric Vehicles It S Time To Bust Another Ev Myth

Latest On Tesla Ev Tax Credit February 2022

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Yaa