maine property tax calculator

Property tax rates in Platte County rank in the bottom half of Nebraskas 93 counties. Our property records tool can return a variety of information about your property that affect your property tax.

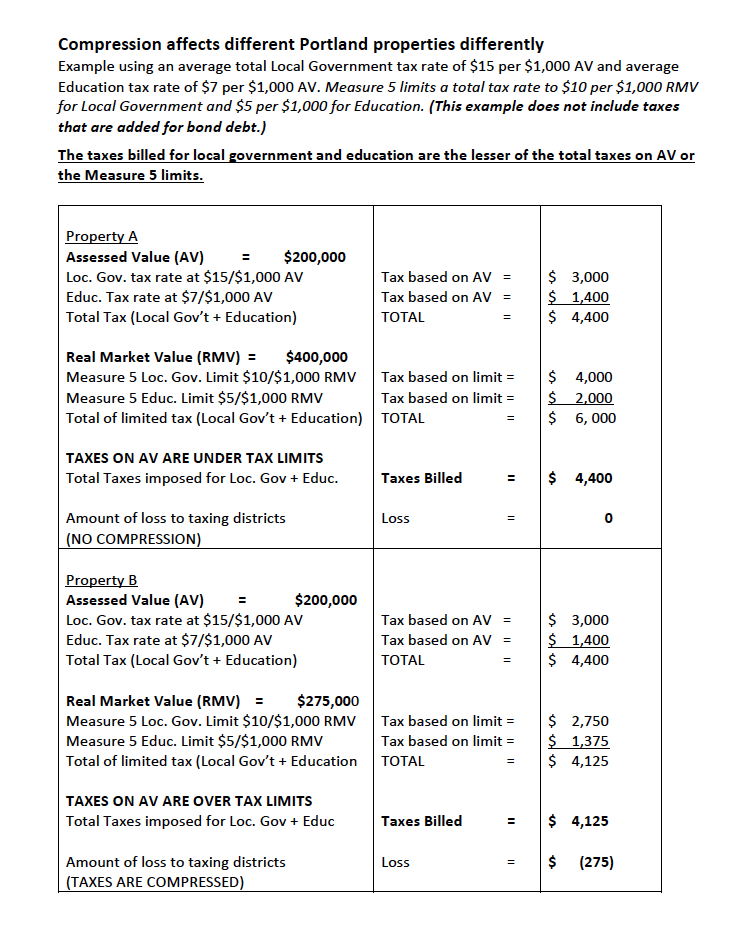

Property Taxes Compression Ballot Measures League Of Women Voters Of Portland

The median property tax payment in Texas is 3390 and the median home value is 200400.

. See terms and conditions for details. Homeowners in Nevada are protected from steep increases in property tax bills by Nevadas property tax abatement law which limits annual increases in property tax bills to a maximum of 3 for homeowners. When contacting Cherokee County about your property taxes make sure that you are contacting the correct office.

The state sets certain guidelines and assists counties with administering the property tax but counties are responsible for the appraisal of property and the calculation of tax rates. The countys average effective property tax rate of 100 is the lowest in the state and well below the state average of 130. How the Utah Property Tax Works.

Harris Countys 3356 median annual property tax payment and 165300 median home value are actually not that far off the statewide marks. Tax amount varies by county. The exact property tax levied depends on the county in Ohio the property is located in.

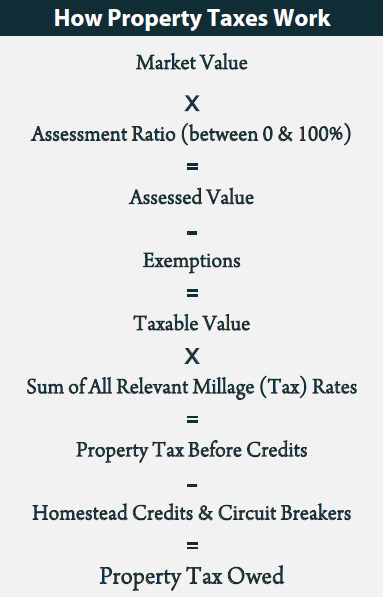

Property tax is a system of taxation that requires owners of land and buildings to pay an amount of money based on the value of their land and buildings. Finally we calculated a property tax index based on the criteria above. You can use this tax calculator to.

Your household income location filing status and number of personal exemptions. Calculate your expected refund or amount of owed tax. To estimate your yearly property tax in any county based on these statistics you can use our property tax calculator.

The states average effective property tax rate is just 053. Maine 109 19 Minnesota 105 20 Massachusetts 104 21 Alaska 104 22 Florida 097 23 Washington. 2021 HRB Tax Group Inc.

Property taxes in Utah are largely handled at the county level. States with the lowest property tax rate are ranked lowest whereas states with the highest rates are ranked highest. The average effective property tax rate in Platte County is 151.

The median property tax payment in the county is just 1433. HR Block Maine License Number. The exact property tax levied depends on the county in Iowa the property is located in.

Like the Federal Income Tax Louisianas income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. Johnson County collects the highest property tax in Iowa levying an average of 143 of median home value yearly in property taxes while Pocahontas County has the. All other property types such as townhouses and condos will have an additional surtax that increases the transfer tax rate to.

Overview of Colorado Taxes. The median property tax in California is 074 of a propertys assesed fair market value as property tax per year. Colorado Property Tax Calculator.

Were proud to provide one of the most comprehensive free online tax calculators to our users. Connecticut Property Tax Calculator. Ohio is ranked 20th of the 50 states for property taxes as a percentage of median income.

The state has an average effective. Property taxes in Maine are an important source of revenue for local governments and school districts. That rate comes in above both national and state averages.

Similar to Douglas County the majority of property tax revenue in Dodge County goes to school districts. Miami-Dade Countys transfer tax rate depends on the property type. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address.

Property Tax Calculator - Estimate Any Homes Property Tax. Single-family homes in Miami will have a transfer tax rate of 060. Louisiana collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Maine residents seeking low property tax rates might want to consider Hancock County. County Median Home Value Median Annual Property Tax Payment Average Effective Property Tax Rate. Notably Louisiana has the highest maximum marginal tax bracket in the United States.

To find more detailed property tax statistics for your area find your county in the list on your states page. Californias median income is 78973 per year so the median yearly. The following tables are sortable.

Calendar Year 2016 Property Taxes. Compared to the 107 national average that rate is quite low. Homeowners in Olmstead County where Rochester is located face an average effective property tax rate of 120.

Use our free Maine property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Overview of Connecticut Taxes.

Places where property values rose by the greatest amount indicated where consumers were motivated to buy homes and a positive return on investment for homeowners in the community. California has one of the highest average property tax rates in the country with only nine states levying higher property taxes. Maine Tax Calculator Maine Property Records Maine Tax Assessors Maine Property Tax Percentage.

Box 1060 Augusta ME 04332-1060. Check your eligibility for a variety of tax credits. Link to this page.

Connecticut homeowners pay some of the highest property taxes in the country. Iowa is ranked 26th of the 50 states for property taxes as a percentage of median income. The Commissioners Court sets the Harris County property tax rates.

Estimate your federal and state income taxes. The states average effective property tax rate taxes as a percentage of home value is 214 which ranks as the third-highest of any state in the US. You can call the Cherokee County Tax Assessors Office for assistance at 256-927-5527Remember to have your propertys Tax ID.

The first step in Utahs property tax system is the valuation. Then we calculated the change in property tax value in each county over a five-year period. Census Bureau Annual Survey of State and Local Government Finances.

Delaware County collects the highest property tax in Ohio levying an average of 148 of median home value yearly in property taxes while Monroe County has the. Colorado Property Tax Rates. Click on any column header to sort by that column.

Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010. The median annual property tax paid by homeowners in Scott County is 3303 which ranks as one of the highest annual taxes in the state. Please note that we can only estimate your property tax based on median property taxes in your area.

Florida Property Tax H R Block

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Alameda County Ca Property Tax Calculator Smartasset

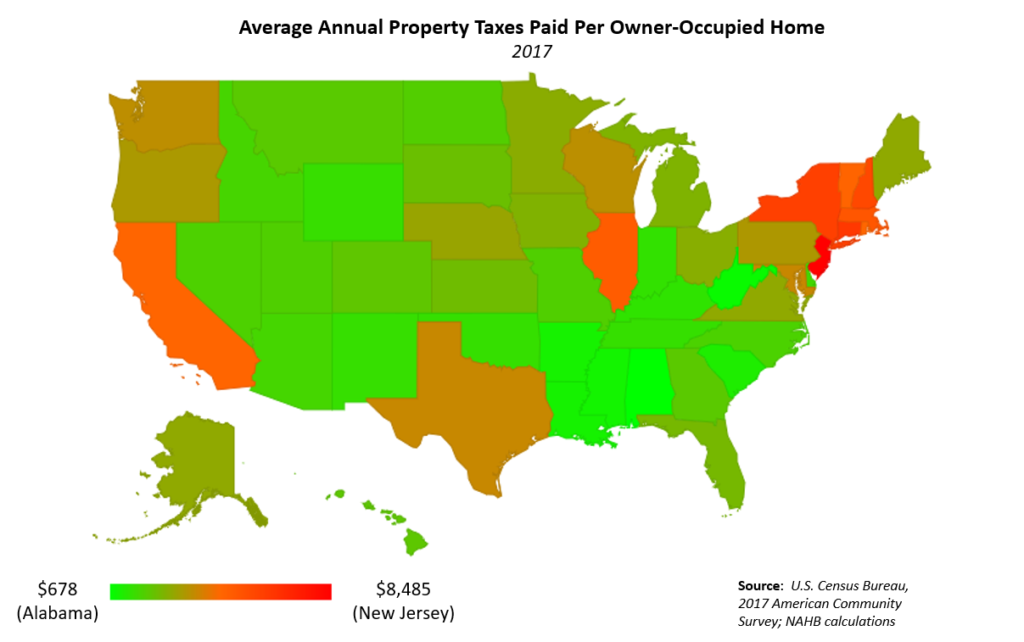

Property Taxes By State 2017 Eye On Housing

Property Tax How To Calculate Local Considerations

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Compound Interest Calculator Debt Solutions Compound Interest Interest Calculator

2022 Property Taxes By State Report Propertyshark

York Property Tax Rate Falls As Town S Valuation Climbs 15 In One Year Maine In The Fall Property Property Tax

Maine Property Tax Rates By Town The Master List

Paradym Fusion Viewer Beautiful Lakes Property Tax Boat Storage

623 Main Street Real Estate Commercial Property Tours

Village Land Shoppe Flagstaff Property Taxes Coconino County Taxes

What Is A Homestead Exemption And How Does It Work Lendingtree

Property Taxes By State 2017 Eye On Housing

Ask Hannah Holmes Your Home Maintenance Questions Answered Home Maintenance Old Farm Houses Help Wanted